Money worries during the coronavirus pandemic

The impact of the coronavirus pandemic is being felt across the economy, government, businesses and individuals. People are under financial pressure as a result of a loss of their livelihood or reduced incomes. This article provides links to key government and charitable organisations and their websites.

I am struggling financially, what help is there?

The Citizen’s Advice Bureau has produced an advice guide for all things related to coronavirus and many of the topics relate to financial hardships and associated problems. It can be found here:

https://www.citizensadvice.org.uk/health/coronavirus-what-it-means-for-you/

If you need independent debt advice visit an advice charity such as Stepchange, Money Advice Service, the National Debt Line or the Citizens Advice Bureau.

Benefits

Where someone is reduced to low-income as a result of the crisis they may be entitled to Univeral Credit. You could also get Universal Credit on the basis of remaining at home on government advice:

- If you don’t qualify for Statutory Sick Pay (SSP) or Employment and Support Allowance (ESA) or

- You need additional help on top of SSP or New-style ESA.

There is at least a five-week wait before you get Universal Credit, but you can get help from day one through a Universal Credit Advance Payment. Advance payments have to be paid back out of your Universal Credit payments and must be paid back within 12 months.

Universal Credit is claimed online. To apply please click HERE.

People who need to claim Universal Credit because of coronavirus will not have to produce a fit note.

Kidney Care UK provides more information about benefits here.

In addition, as a renal patient other support and grants may be available: https://www.sgkpa.org.uk/main/money-difficulties

Mortgage, Rent, credit card, utility company issues

Mortgage

If you are a home owner with a mortgage you may be entitled to a 3-month mortgage holiday (You MUST agree this with your lender). This allows you to defer payments although you will owe more at the end of the payment holiday. MoneySavingExpert have produced a financial guide that you might find helpful. https://www.moneysavingexpert.com/news/2020/03/uk-coronavirus-help-and-your-rights/

Rent

The government has brought forward a package of measures to protect renters affected by coronavirus (COVID-19). With these in force, no renter in either social or private accommodation will be forced out of their home.

More can be found at the government site.

Other lenders (Credit card & loan companies)

https://www.moneysavingexpert.com/news/2020/03/uk-coronavirus-help-and-your-rights/

This article also offers advice and help available from credit card and other lenders, as well as help from gas, water and electricity companies. In all cases you should call your provider and explain your situation and reach a mutually agreed plan of action. You risk missing out on some of these schemes if you act unilaterally.

Utility companies

Utility companies have said that they will look at issues related to coronavirus on a case-by-case basis, but many have said that they will consider pushing back bill due dates, offer alternative payment arrangements and remove debt charges for late payment. If you are having issues, make sure you contact your supplier as soon as possible.

Pre-pay meters – If you are unable to afford to heat or light your home, this article has useful advice on help from your utility companies’. All UK domestic energy suppliers have signed up to an agreement to help people during these challenging times. The measures mean people on prepayment meters will have a range of options to ensure continuity of supply even if they cannot add credit, and people on credit meters (paying for energy used) will be offered support and will not be disconnected.

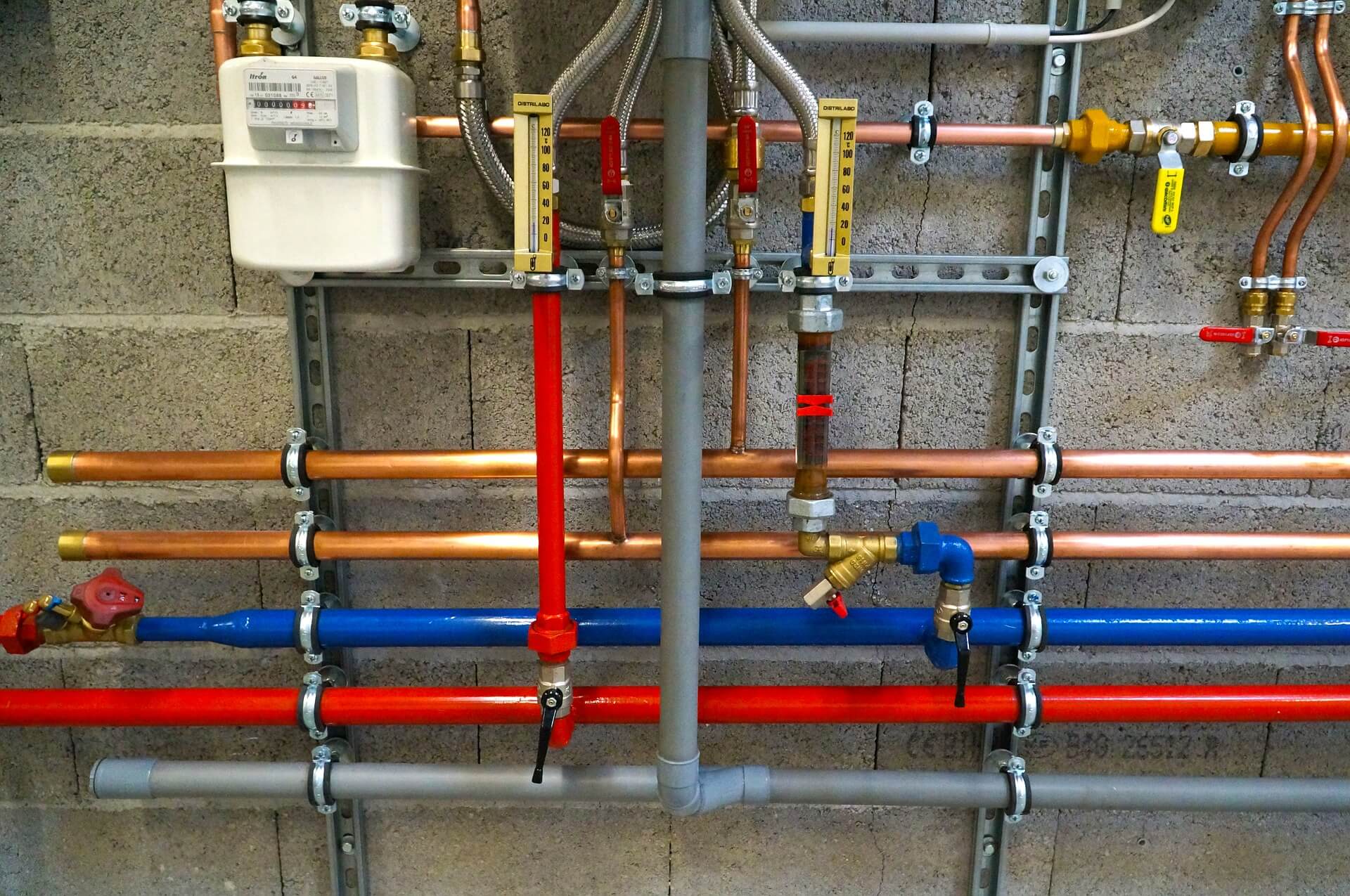

Problems with heating, electricity or water

Firstly you should, if not already, register with the Priority Service Register. This service ensures that in an emergency loss of service, your service is restored as a matter of priority.

You can register for energy and water here:

- Energy: UK Power Networks

- Water: South East Water, Southern Water, SES Water, Thames Water

A guide and more information can be found here:

https://www.kidneycareuk.org/get-support/priority-services-register-psr/

In the case of a gas leak you should follow the instructions here:

https://www.britishgas.co.uk/help-and-support/breakdowns/gas-leaks

Salary, Sick Pay & Medical support

Salary Support

If you are employed but are currently not working due to the coronavirus, the government’s intent is that you should still receive a salary greater than Statutory Sick Pay (SSP).

Furlough Scheme – Your employer will be able to access grants from HM Revenue and Customs (HMRC), by the end of April 2020 to cover 80% of gross wages in the private sector, up to £2,500 a month, for those not working and who would otherwise have been laid off. These will be backdated to March and the scheme will last three months at least. Find out more here.

What support is available for the self-employed?

The government has said it will make it “quicker and easier” for self-employed people seeing a sudden drop in income to access benefits. Those on contributory Employment & Support Allowance (ESA) will be able to claim from day one, instead of day eight. The minimum income floor, which would typically take into account expected monthly earnings when calculating entitlement to Universal Credit, has been removed. Not having the floor means that self-employed people are able to claim for time they spend off work due to sickness. It means self-employed people can now access, in full, Universal Credit at a rate equivalent to SSP for employees.

Suspension from work due to medical conditions

People with transplants or on dialysis are being told that they must ‘shield’ for 12 weeks. In some cases, workplaces are enforcing this for their employee’s wellbeing. If you are suspended from work for health and safety reasons then you should be entitled to full pay for up to 24 weeks. Find out more here.

Statutory Sick Pay

If you are an employee remaining at home, but not working, on government advice you should (as a minimum) get Statutory Sick Pay (SSP) from your employer, as long as you usually earn more than £118 per week. You will get this from day-one of your self-isolation. People on zero-hours contracts can still get SSP if they meet the conditions. This is claimed directly from your employer.

Government Grants & business support

There are a number of government schemes to help the self-employed through grants paid in June, company loans, a “furlough scheme” that means the government pays 80% of an employees salary (up to £2500 a month) instead of the company laying them off.